The Quarterly Checkup

Q3 2024 Market & VC Landscape

Monday, 02 December 2024 I Written by Jason Robertson

Market Overview

Distributions. Or more importantly, the lack thereof. If you are a venture capital firm, or a limited partner or prospective investee of one, this word is haunting (see what I did there for Halloween!?) in the current environment. Some $4 trillion in value is locked up in VC- backed companies in the US alone. The overinflated valuations set in 2020 and 2021 burned many companies' willingness to exit, and investors' holding value of those stakes is teetering as ventures head back to the markets for either their redemption or reckoning.

In Q2, I shared with you the mixed signals that we are experiencing: slowing inflation, lowered interest rates, and public stock markets hitting all-time highs with most measures of valuations also at generational highs. All signals that would have suggested bullish sentiment in venture investing. Yet despite those seemingly positive signals, the

game on the field is feeling anything but, and distributions may be part of the reason why. PitchBook’s latest Q3 data indicates that distributions to LPs is occurring at single-digit rates – 5.2% as low as during the global financial crisis in 2007 – and has been for the past two years compared to the average rate of almost 17% for most of the past decade.

In Q2, I shared with you the mixed signals that we are experiencing: slowing inflation, lowered interest rates, and public stock markets hitting all-time highs with most measures of valuations also at generational highs. All signals that would have suggested bullish sentiment in venture investing. Yet despite those seemingly positive signals, the game on the field is feeling anything but, and distributions may be part of the reason why.

PitchBook’s latest Q3 data indicates that distributions to LPs is occurring at single-digit rates – 5.2% as low as during the global financial crisis in 2007 – and has been for the past two years compared to the average rate of almost 17% for most of the past decade. This lack of liquidity has caused GPs to significantly slow their capital calls over the prior quarters as they remain cautious of doing so without also returning capital to their LPs to justify their continued investment. This liquidity crunch can also be felt in the number of active investors participating in financings in Q3, which has fallen 55% since 2021 highs.

As predicted, Q3 saw the Federal Reserve cut its overnight interest rate by 50-bps to a range of 4.75-5.00% in September and at that time prognosticators still saw another 50-bps of rate cuts happening before the end of the year. In November, the Federal Reserve dropped the overnight rate by another 25-bps to 4.50-4.75% and another 25-bps reduction is expected at the December meeting; however, Fed Chair Powell has been vocal about the strength and resiliency of the US economy and some believe that rates will stay in this range for an elongated period. Furthermore, post-election long-term bond rates have risen in anticipation of increased government spending, reduced taxes, potential tariffs, and reduced regulation all expected to lead to substantial inflation over the next 5-10 years.

Speaking of election, former president Donald Trump has been re-elected in a fairly decisive victory and though the reduced uncertainty has caused US stock markets and cryptocurrencies to rip (the S&P 500 is up almost 27% this year and 6% since the president-elect’s victory and bitcoin is up 45% since the election), new uncertainties are creeping amidst the euphoria regarding the economic impact of additional tariffs.

Not to be outdone, the Bank of Canada issued its own 50-bps rate cut in October following its 75-bps cuts through the summer and another 50-bps rate cut in December is possible, especially in light of the risks and economic harms anticipated from increased US tariffs on Canadian exports. For those keeping score at home, the Bank of Canada interest rate currently stands at 3.75% and most economists are modeling a 100-bps spread between US and Canadian interest rates moving forward and a sub $0.70 loonie, last seen more than two decades ago.

Though 14 companies went public in Q3, the exit markets for VCs remained difficult and total exit value was only $10B; however, the market is optimistic for an IPO renaissance in 2025 under Trump There was a glimmer of hope at the end of the quarter with Cerebras’ IPO filing, a $4B valued manufacturer of AI chips, expected to be one of the larger IPOs upcoming. Other companies such as Stripe, SpaceX, Klarna, CoreWeave, and StubHub are all expected to IPO in 2025 driving enthusiasm. Again, staying private for longer as companies wait for a more favourable dealmaking environment has caused private company inventory to expand to >57,000, a record high.

VC Ecosystem Overview

The venture ecosystem has hopefully found its footing as deal volume seems to have bottomed and stabilized in Q3 although a rebound has yet to materialize despite the glimmer of hope seen in Q2’s uptick. Unfortunately, Q3 recorded 3,775 deals completed – an 11% decrease from Q2. As hinted last quarter, our anecdotal conversations aligned with the bump in Q2 deal value but we continue to see challenges in getting new financings over the line and would expect Q4 to be more of the same. Despite only a modest reduction in deal volume, deal value was crushed 32% to $38B and while I would normally be more concerned, Q2’s $56B was driven in part by two deals (CoreWeave and xAi) that accounted for almost $15B and megadeals as a whole accounted for $34B. In Q3, the largest financing was Anduril Industries’ $1.5B Series F, a far cry from Q2’s deals.

Q3 2024 again demonstrated investor-friendliness in the current macro environment; however, early-stage AI and ML deals are leading a reversion to a more neutral market whereas deals outside this remain very investor-friendly.

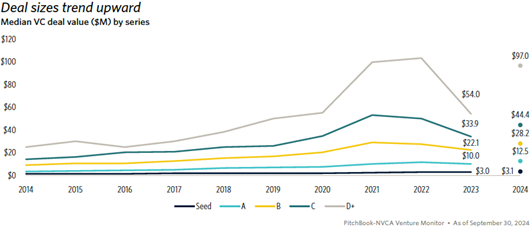

Across the board, deal sizes trended upwards in Q3 and – assuming that dilution needs to remain constant – it is no surprise that deal valuations have ticked up as well.

As stressed earlier, the lack of LP distributions continue to disrupt financing models thereby preventing LPs from committing to new funds. This trend is illustrated by the VC 12-month distribution yield as a percentage of net asset value (NAV) for funds aged five to 10 years, which fell to a near low of 5.2% in Q3, well below the 10-year average of 17.1%. Furthermore, fund count is expected to finish the year at the lowest number in a decade.

Despite this and with $65.1B committed to 380 funds YTD, 2024 may ultimately exceed 2023, albeit with significant mortality for emerging managers, who are facing even greater hurdles due to hesitant LPs. Through Q3, despite similar fund counts, emerging funds raised $12.2B, compared with experienced funds that raised $52.9B, or more than 81% of the capital raised in 2024. In addition, almost $46B, or 70% of fund raised, went to funds larger than $500M and only $4.1B went to first-time VC fund managers. Thus, many GPs are delaying fundraising until 2025 and beyond awaiting improved market conditions. This fundraising difficulty is also evident in timelines as the average time to close a new fund has hit 17 months, the longest on record.

VCs have consequently slowed their deployment pace to extend their existing funds while trying to improve their fund performance metrics including DPI before raising a subsequent fund. As such, many VCs are investing more resources (time and money) in existing portfolio companies and helping them weather the difficult financing environment. Thus, deals are taking longer to close, more due diligence is being undertaken, and hurdles have increased to deploy capital.

Although record-high VC dry powder persisted in Q3, an interesting development occurred in that it grew meaningfully to over $328B from Q2’s $296B.

VC Digital Health Overview

US digital health funding in Q3 2024 declined from Q2’s $3.0B to $2.4B (down ~20% from Q2) across 110 deals (down from 133 in Q2), with an average deal size of $22.0M (flat from Q2). Average cheque sizes remain flat with 2023; however, Q3 may be demonstrating the softness that we were predicting in Q2. Whether this is a more macro trend or just seasonality remains to be seen. Again, these data suggest a continued flight to quality with fewer deals and more dollars.

Unfortunately, Q3 also saw a worrisome decline in M&A activity of just 21 deals completed, down from 28 in Q2, 37 in Q1, and a quarterly average of 37 in 2023. While much of this slowness is expected since the comparator years of 2021/2022 were fuelled by zero-interest-rate peer/ competitor acquisitions, the reduced opportunity for liquidity will nonetheless continue to weigh heavily in the sector until the momentum changes – but it always does.

Canadian VC Overview

In Canada, VC investment activity for Q3 2024 jumped again to $2.65B, up 6% from $2.4B in Q2, but across 130 deals (down 17% from Q2 and 7% from Q1) as 1 megadeal – Clio, the largest round ever in Canadian history – accounted for $1.25B of that. Average deal value increased another 17% in Q3 vs Q2 to $15.2M; however, stripping out Clio, that number drops to $11M, in-line with Q1. Moreover, 8 mega-deals ($50M+) in Q3 accounted for $1.9B, so accounting for those, that number looks bleak with 122 deals in Q3 at an average deal size of $6.1M, almost half of Q1.

As noted in Q2, Alberta came out swinging (anecdotal feedback from peers remains bullish on Alberta deal flow and Nimbus has now joined the Venture Capital Association of Alberta); however, after generating ~$300M of deal value in Q2, Q3 saw a reversion to Q1 numbers with $95M raised although BC and Alberta remain neck-and-neck for deals YTD.

Seperating the data out by investment stage and sector provides further context – albeit not still disconcerting but perhaps with a silver-lining. Pre-seed activity remains depressed in Q3 but showed some acceleration with 33 deals and $29M. Average deal size also ticked up to $0.88M in Q3, but still down a third from the five-year average of $1.35M. Seed deal volume remains slowed further from the last few quarters at 37 deals (vs 53 in Q2 and 51 in Q1) whereas average deal size increased dramatically to $3.5M from $2.6M in Q2 and $2.4M in Q1, further supporting the narrative of a flight-to-quality with more money invested in fewer ventures.

Series A and B activity seemed eager with >$900M invested across 55 deals (up 33% from Q2’s 41 deals) with an average deal size of $16.6M, down and closer to Q1’s $15.3M.

While early- and late-stage financings in Canada will be at worst flat from 2023 and more likely up in 2024, pre-seed and seed stages remain gutted and are unlikely to recover in Q4. This has not appeased our deep concern over the health of the Canadian VC ecosystem as deal counts should be highest at the earliest stages of investment (top-of-funnel) in recognition of attrition at further stages of investment. The contnuned risk-off behaviour of investors shifting to Series A and B funding rounds will hinder the replenishment of new ventures.

Looking specifically at sectoral performance in Canada, though all sectors are set to exceed funding from 2023, all are equally unlikely to surpass deal counts from last year.

Even Canada is lacking in distributions although recent tax and other policy changes may be significant contributors as well.