The Quarterly Checkup

Q1 2024 Market & VC Landscape

Wednesday, 22 May 2024 I Written by Jason Robertson

Market Overview

As has been central to the public market’s psychology in 2023 and into 2024, interest rates remain a primary focus with the recent slate of economic data suggesting more persistent inflation in the US and moderation in Canada. Despite increasing geopolitical tensions in Europe and the Middle East throughout the quarter, the S&P 500 ripped 10.2% higher (NASDAQ up 9.1% in the same time frame) in Q1 2024 due to investor expectations of interest rate cuts in the second half of 2024. However, markets corrected quickly in April dropping 5.2% based on March’s inflation print (NASDAQ down 6.7%), which was reported higher than expected at 3.5%, up from 3.2% in February, and marked the third consecutive month of acceleration. Core inflation (stripping food and energy) was up at 3.8%. Prior to March’s inflation print, markets had been expecting three interest rate cuts by the US Fed in 2024 starting in June; however, markets are now anticipating at best two cuts in 2024 with the first occurring in September. Even more concerning is that some prognosticators think a rate increase may be possible this summer although this is considered unlikely so close to the US Presidential election in the fall. Despite concerns of continuing or increasing inflation, the markets have seemingly shrugged this off after digesting the latest data, causing markets to reverse course, and once again climb to new highs.

Interest rates are inversely correlated with asset values: that is, as rates increase, the value of assets decrease and that is what was seen through 2022 as the US Fed hiked rates quickly causing a decline in the S&P 500 and NASDAQ indices. This also caused the NASDAQ to re-converge with the S&P 500 as high growth assets were no longer prized for their future cash flows in a high(er) rate environment.

However, since 2023, the public markets – particularly the tech-heavy NASDAQ – have been on a tear and this seems related to the introduction of ChatGPT and the hype associated with AI entering the zeitgeist. This has seemingly persisted in maintaining the market at historically extreme valuations.

In Canada, inflation come in at 2.9% for March, as expected, marking the third straight month of easing price pressures. This has led markets to increase the probability of a June rate cut by the Bank of Canada (BoC). While this may seem positive on the surface, especially for those of us in Canada with variable rate mortgages, this divergence from the US economy may cause the BoC to cut rates sooner and deeper than the US Fed, which could send the Canadian dollar spiralling downward against the US greenback.

In summary, the early indicators from the beginning of 2024 are not moving in the direction the market was hoping for and uncertainty has increased as to what investor sentiment will be in the back half of 2024 and into 2025. Coupling these early data points with the increasing geopolitical risk in Europe and the Middle East and it is possible that the investor sentiment could turn, and a significant market correction could occur.

VC Ecosystem Overview

The venture market through Q1 was cautiously optimistic about an upbeat 2024 with expectations that interest rate cuts and successful IPOs would drive positive investor sentiment. Anecdotally, many VCs we know reported seeing significantly more deal flow in Q1 than in 2023; however, this did not translate into growth activity for the quarter and remains to be seen if that deal flow will lead to deal value in subsequent quarters. In fact, Q1 2024 represented the lowest deal value since 2018 and as we cautioned previously, pre-seed and seed stage deal value slumped 39% this quarter compared to Q1 2023 as the sluggish venture market may have finally trickled down to the earliest stages of the venture lifecycle.

Q1 2024 again reflected the increase in investor-friendliness in the current climate as investors have not only sought down rounds, but also added structure such as cumulative dividends and liquidation preferences to gain downside protection. This is exacerbated by the demand/supply ratio of ~2x: a significant mismatch of the capital that >55,000 VC-backed companies in the US are seeking versus what investors are willing to invest.

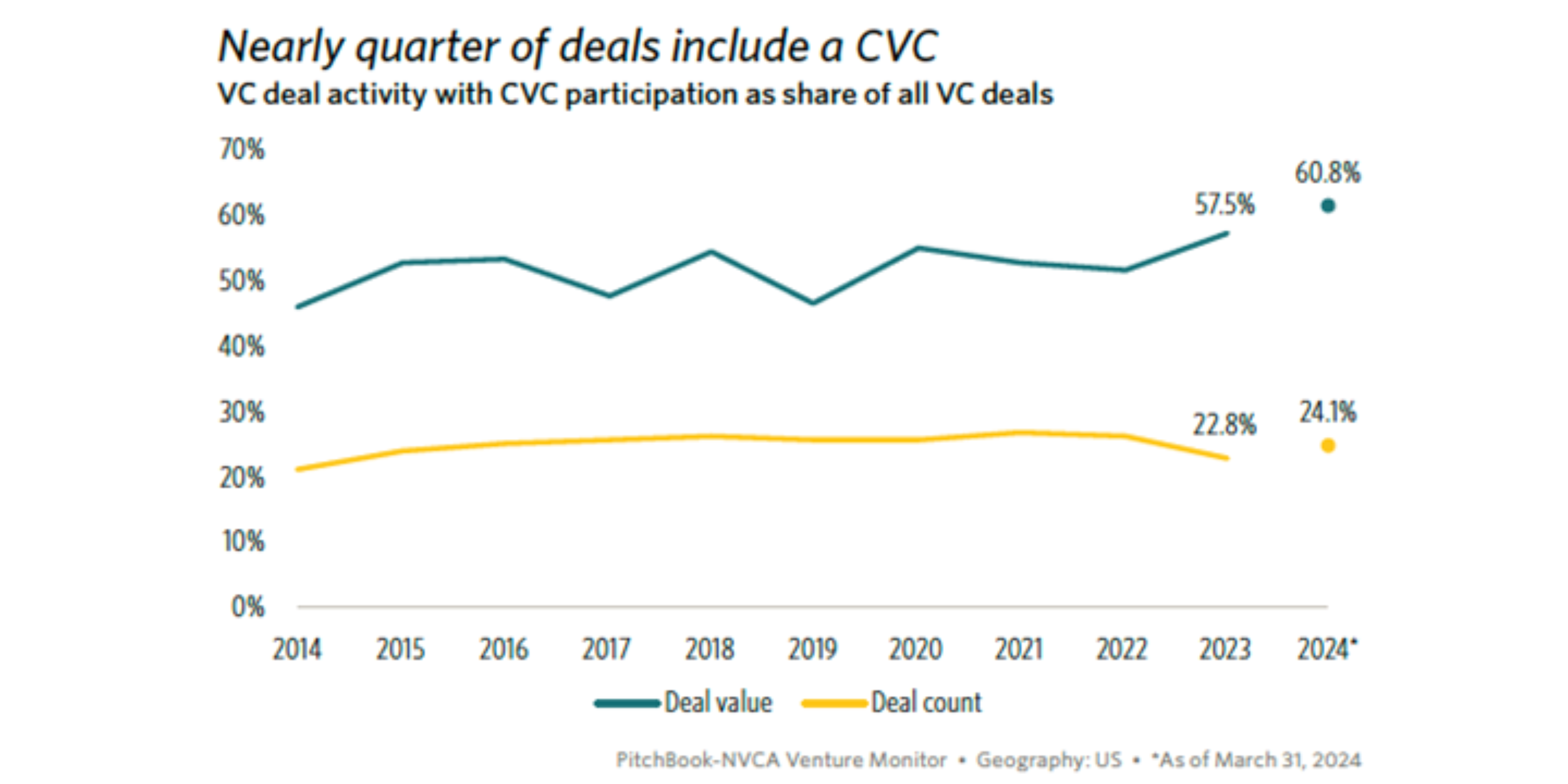

Interestingly, corporate VCs (CVCs), especially those investing from their balance sheets, have historically been regarded as fair-weather investors: they are late to the party as markets heat up and the first ones out when the party stops. Thus, it is no surprise that CVC activity is ebbing in this difficult market; however, those CVCs who remain are playing a bigger role with nearly 25% of all venture deals including a CVC and that involvement accounting for over 60% of the deal value. Anecdotally, Nimbus’ recent investments support this with most of the deals completed in the last six months including a meaningful CVC presence.

Record-high VC dry powder increased again in Q1 to $312 billion, roughly 60% of which is held in funds with commitments exceeding $500 million, and 73% is allocated to funds from 2020-2022. In 2022, nearly half of all capital committed went to funds over $1 billion and established managers secured more than 70% of new commitments. That trend continued in 2023 with $67B raised across 474 funds – the lowest dollar value in six years and the lowest fund count in a decade. Furthermore, 75.3% of total capital raised was placed with established managers and capital raised by first-time funds fell to a seven-year low for value and a decade low for count. This concentration of capital into the largest multi-stage funds has been driving pre-seed and seed stage valuations up as junior team members are given carte blanche to write option cheques into these opportunities to keep busy while the firms look after their portfolios as the late-stage markets reset.

Despite this dry powder, many VCs are still deploying capital at a much slower pace. It is believed that increased liquidity from future IPOs will help lubricate the venture markets as LPs recycle distributions into current commitments. Thus, all eyes remain glued on recent public debuts and what they indicate for future IPOs. As noted above, increasing confidence in public markets and related performance coupled with expanding revenue multiples may allow more VC-backed companies to become public in the near- to medium-term.

Instacart’s stock – which went public in fall 2023 – has increased above its IPO price, but Klaviyo – which went public around the same time – has fallen below. New public market tech entrants Reddit and Astera Labs had strong debuts and – for now – have held above their first day pops. Though this is a positive signal for IPOs and perhaps increasing risk appetite in the public markets, the bid-ask spread between buyers and sellers remains a hurdle due to valuations from a couple of years ago. This, in turn, has forced both pre- and post-IPO companies to shift quickly toward profitability while maintaining acceptable growth. All of the unicorns that have gone through an IPO over the past few quarters have transitioned to EBITDA positive or have recorded a profit prior to their debut

VC Early-Stage Overview

In Q1, $2.6B was deployed in pre-seed and seed stage deals and as noted above, represented a 39% slump in deal value; however, valuations not only increased but deal sizes ticked up slightly as well. The interpretation may be that this represents a flight-to-quality by investors where more money is being invested into fewer ventures and consequently at higher valuations to ingest that increased amount of capital.

Relatedly and as noted last quarter, many venture-backed companies continue to resort to creative financing structures to survive the capital-constrained environment in 2023, including measures such as round extensions, unlabeled raises, and silent deals from existing investors. Nimbus still expects these deals to dissipate through the year as both ventures and investors align on valuations and more traditional structures once again become the norm, especially in the US; however, this trend increased in Q1, especially in digital health with 48% of deals completed unlabeled, compared to 44% in 2023. These strategies help companies buy time and make operational adjustments to reduce reliance on external capital; however, these strategies also tend to be non-public and thus are not reflected in the reported funding numbers making it difficult to evaluate and prognosticate on the health of the VC market heading through 2024. Furthermore, these financing strategies are most likely one-time only interventions and cannot be depended on for further funding. Startups unable to meet the necessary milestones for their next funding round will confront difficult choices in 2024: raise funds at potentially reduced valuations, seek acquisitions or exits, or shut down. This transition phase may lead to a smaller cohort of stronger players, especially in the digital health sector.

VC Digital Health Overview

In US digital health, after capping off the worst fundraising year since 2019, hopes were high that Q1 2024 would mark a meaningful transition to a new funding cycle; however, as noted above, creative financings increased in digital health in Q1 with AI driving investment interest with an increasing focus on a startup’s ability to demonstrate improvements in outcomes.

US digital health funding in Q1 2024 moved up markedly from Q4’s $1.9B to $2.7B (up ~42% from Q4) across 133 deals (up ~9% from Q4), with an average deal size of $20.6M (up ~32%). While average cheque sizes were up from Q4, they remain depressed from Q1 2023 and reflect 2018/2019 values. Furthermore, and if 2023 is any indication, deal size may continue to drift downwards after a strong first quarter performance to the historical norm of ~$15M as with Q4 2023. That said, Q1 2024 once again reinforced deal volume consistency over the last 6-7 quarters. While Q1 deal value was up meaningfully from Q4, Nimbus believes this is more likely evidence of the seasonality of funding seen in the last few years given the broader US venture market slowdown in Q1.

Since Nimbus’ inception, the firm has highlighted to startups the importance of generating outcomes data for their solution; however, historically outcomes reporting has been inconsistent and not always necessary to sell to customers. Looking forward, Nimbus has shared its belief that a focus on outcomes will become more important for the next generation of digital health startups. This view was further heightened by a report published by the Peterson Health Technology Institute on digital diabetes management solutions that concluded “… [these solutions] do not deliver meaningful clinical benefits, and they increase healthcare spending relative to usual care.” Testing and comparing outcomes is difficult, especially for solutions serving patients with multiple conditions and equity considerations; however, as digital health becomes more crowded, enterprise buyers are using outcomes data to differentiate players and assess value-for-investment. Consequently, investors are prioritizing companies that can demonstrate efficacy early, making outcomes data central to fundraising discussions at earlier stages.

Looking forward in 2024, the actions taken and decisions made by digital health startups in the last 12-18 months will come home to roost necessitating fundraises with priced rounds, possibly at adjusted (down) valuations, M&A at lower-than-hoped for valuations, or the difficult prospect of winding up operations. While some anticipate M&A activity accelerating, buyers are also sensitive to interest rates and a “higher for longer” environment may prevent a meaningful uptick even at bargain basement prices. Despite potential closures, the digital health ecosystem is expected to remain innovative and resilient, with emerging segments like digital obesity care and value-based care enablement gaining traction.

Canadian VC Overview

In Canada, VC investment activity for Q1 2024 also hit a low point of $1.3B across 128 deals – the lowest since 2020 and similar to 2019. Notwithstanding the outlier of Q2 2023, Q1 continued the downward trend in deal volume while remaining static in deal value. Deal volume finished at 128 in Q4 (vs 145 in Q4 and 149 in Q3) and deal value decreased to $1.3B (down 13% from Q4’s $1.4B).

Similar to the US, deal counts dropped 28% year-over-year in Q1 offset by a 47% increase in average deal value to $10M implying a flight-to-quality with more money invested in fewer ventures.

Separating the data out by investment stage and sector provides further context. Annual pre-seed and seed activity seemingly collapsed in Q1 with only 11 deals and $15M invested compared to the $47M invested across 37 deals in Q1 2023. For trend comparison, there was 25 deals in Q4, 31 in Q3, and 34 in Q2 – a concerning trend. Average deal size ticked up to $1.36M from $0.97M in Q4, $1.4M, in Q3, and $1.0M in Q2. Seed deal volume was down slightly to 50 deals (vs 53 in Q4, 49 in Q3, and 68 in Q2) whereas average deal size decreased meaningfully to $2.15M from $3.7M in Q4, $3.9M in Q3, and $3.7M in Q2.

Series A and B activity seemed more robust with $576M invested across 38 deals and Series A funding was particularly strong, with $282M invested across 18 deals. This does cast a pall over the Canadian VC ecosystem health as deal counts should be highest at the earliest stages of investment (top-of-funnel) to support attrition for further stages of investment and the risk-off behaviour of investors shifting to Series A and B funding rounds may in the future hinder the replenishment of new ventures. While this may be an overall concern for the ecosystem, this could provide Nimbus a bullish opportunity for the highest quality opportunities in those earlier stages.

From a sector perspective in Canada, the ICT sector appeared to get crushed back to 2020 peak pandemic levels with only $464M contributed across 69 transactions. Unless there is a pickup in pace in subsequent quarters, 2024’s start would imply the worst funding year since prior to the pandemic. Conversely, Life Sciences slayed with $425M across 30 deals, a ~200% increase in deal value versus Q4; however, this was driven largely by two mega deals worth a combined $332M